Underrepresented Fund Managers: An Overlooked Opportunity

Current 11 - Insights:

Last month, Align team members headed to Washington, D.C. to attend Include Ventures' Annual Impact Conference. Include Ventures (IV) is a fund of funds focused on accelerating women and historically underrepresented fund managers and founders. Alongside its sister organization, nonprofit VC Include, IV seeks to foster a more inclusive, impactful investment ecosystem.

For the occasion, Limited Partners (LPs) and General Partners (GPs) gathered at The Autoshop, an industrial-style venue situated in the heart of DC's historic Union Market District. A crossroads of commercial activity since 1871, the site has maintained a certain buzz through the decades. One can imagine the raucous shouts of vendors and odors of fresh fish and meat that once filled the neighborhood. Fast forward to 2024, and the market is home to a colorful medley of food and drink purveyors, shops, and art and entertainment options. Next door at The Autoshop, where ideas and inspiration flowed freely, one could imagine the long history of exchange on top of which the day unfolded.

The conference featured panels on topics such as how family offices approach impact investing, how foundations can leverage their grant-making and program-related investments to support emerging fund managers, and how to unlock philanthropic capital to de-risk investments. Conversations wove between the philosophical and the pragmatic, with panelists posing questions on how we should define and incorporate inclusivity in investment decision-making as much as they offered tools and tips for increasing access to capital.

Funlola Otukoya, Investment Manager at the McKnight Foundation, offered a handful of such tips. First, LPs are process-oriented, so GPs should do their research on prospective investors and present a case for why their fund would be a fit with the LP’s strategy. Second, that an LP identifies as an impact investor should not suggest diligence will be any less rigorous than it would be for a traditional investment. As investors, it is our job to evaluate risks in potential investments.

Another piece of advice that emerged: Aim to create thousandaires, not millionaires. In venture capital, LPs and GPs derive outsized motivation from the allure of backing a future unicorn. But most companies won’t become unicorns, and most people won’t be millionaires or billionaires. LPs should instead focus on supporting the GPs, who in turn support the founders, that are moving us toward broad-based economic equity, rather than cherry-picking the next entrants to the 1%. This means crafting portfolios in which most, if not all, businesses have a solid shot at sustainable success, rather than a portfolio of one or two moonshots and dozens of duds. If the math pencils out to roughly the same level of financial return, why wouldn’t we aim for a collective net benefit that uplifts more rather than few?

LPs weren’t the only ones dispensing wisdom. GPs’ voices were well represented throughout the day, as they shared stories of their fundraising and deployment journeys. Key themes included maintaining resilience, practicing authenticity, and building the right team around you. Himalaya Rao, Founder and GP at the BFM Fund, spoke to the importance of amplifying your voice and presence, particularly for women and underrepresented GPs. Summing up this lesson, she advised: “Don’t be too much. Be the most. Unapologetically.”

In addition to LPs and GPs, attendees also heard from one exceptional founder: Samir Goel of Esusu. On a mission to dismantle barriers to housing for working families, Esusu helps renters build their credit histories and scores by reporting on-time rent payments to credit bureaus. Esusu made headlines early in 2022 for raising $130m in Series B funding at a $1 billion (yes, billion with a B) valuation. This fundraise enabled Esusu to scale its team, accelerate new product development, and grow its reach across the rental market. It also offered a crucial signal to investors that there is a legitimate business case for innovations that improve access to housing and help bridge the racial wealth gap. The logic follows that all kinds of businesses with impact at the core of their models may prove to be attractive investments.

Arguably, Goel has done just fine playing by the rules of capitalism as we know it. But in another sense, building and scaling Esusu marks a step toward reimagining that system entirely. What if the unicorns reaching billion-dollar valuations were all impactful companies like Esusu, creating tangible improvements to human life in areas like housing, financial stability, and health? What if the scrappy startup founders of today and tomorrow all sought to replicate that model of success, rather than applying their talents and time to yet another app offering marginal convenience improvements for the already comfortable?

Goel’s advice for getting there? “Be caught trying,” he says.

The Autoshop that day was filled with dreamers and doers out to get caught trying to build a more inclusive, equitable society – one in which capital flows naturally to people and ideas with social and environmental impact strategies baked into their DNA. With the visionary leadership and thoughtful curation of Include Ventures’ Founding Partner Bahiyah Yasmeen Robinson and her team, the room flowed with possibilities of what that society could look like.

—

Align Impact is a committed partner in bringing that reality to fruition. To that end, we want to share our own practical tips for supporting emerging fund managers, particularly those led by women and underrepresented minorities. While definitions vary among asset allocators, Align defines emerging managers as those raising no more than $250m for a Fund I, II, or III, operating outside the infrastructure of a large and established investment firm (less than $500m AUM).

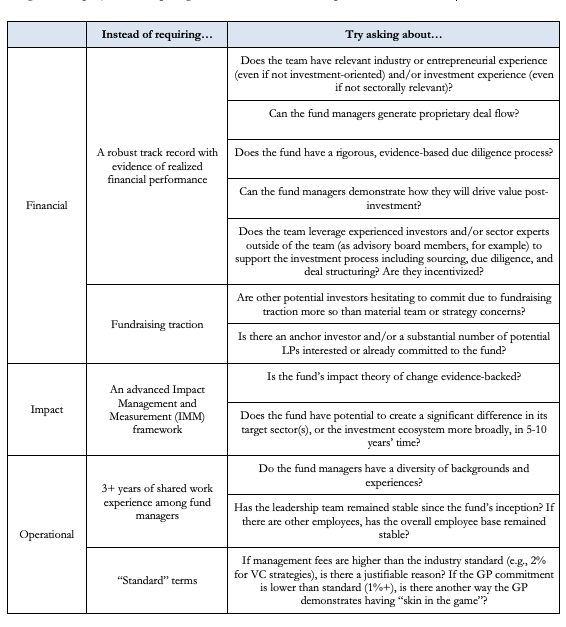

In an effort to confront our own blind spots and play a more catalytic role in backing emerging fund managers, Align has devised a framework to help us rethink traditional due diligence requirements and guide us in holistically assessing whether to pursue further research. Special thanks to the Due Diligence 2.0 project for inspiring this effort. Below is a snapshot of the outcome:

We hope that sharing our framework invites more transparency from other LPs active in emerging manager investments, such that GPs might have a clearer sense of where to turn. Our door is open.

CONFIDENTIAL & PROPRIETARY: The information presented in this blog is the opinion of Align Impact and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Align Impact is an investment adviser registered with the U.S. Securities and Exchange Commission.